Stock Market Brokers Philippines: If you are looking for the best stock market brokers in the Philippines, you have defiantly come to the right place! In this jam pack article, we shall be discussing the best and most reliable stockbrokers in the Philippines.

Table of Contents

Stock Market Brokers In the Philippines

1. Col Financial

Col Financial, formerly known as Citisec Online, is the number one online stock market broker in the Philippines. Col financial is well known for its easy and user-friendly platform. They provide the best online platform, and direct access to market data and statistics, delivering essential research and analysis to keep you ahead in your investments.

They also offer mutual funds, which are very well known for any new stock trading entrepreneur. The company offers an easy and affordable way for Filipinos to invest in using online platforms in the stock market.

How To Open A Col Financial Account?

Online registration is highly recommended this time, and it is more convenient. You can sign up and submit on their official website: signup.colfinancial.com. All instructions are in the link; however, to summarise, you can download the form. (or print and sign) and submit the original documents to the COL Business Center.

What Documents Are Required To Open A Col Financial Account?

- 1 valid government-issued ID

- TIN ID for self-employed, locally employed, and foreign citizens

- 1 valid passport and ACR (Alien Certificate of Registration), or work permit from DOLE for non-Filipino residents

This may differ if you are investing from overseas or are a foreign investor. Therefore, we recommend contacting the Philippines stock broker directly if you have any questions about their service/requirement.

Email: [email protected] Address: COL Business Center, 2403B East Tower, Philippine Stock Exchange Center, Exchange Rd. Ortigas Center, Pasig City 1605 Philippines Opening Hours: Mon – Fri, 8:30 am – 5:30 pm Contact Numbers: +632 86515888 /(+632) 84782954 / (+632) 84783316 /(+632) 84783275 Website: www.colfinancial.com Facebook: facebook.com/colfinancial YouTube: youtube.com/colfinancial Instagram: instagram.com/colfinancial Twitter: twitter.com/colfinancial

Benefits Of Using Col Financial As A Stock Broker in the Philippines.

- Currently, Col Financial Offer The Lowest Commission Rates In The Market

- Very Little Minimum Account Opening (1000 PHP)

- 24/7 Access To COL Account

- Easy To Use For Beginners

- Extensive Research For Investors

- Seminars Are Given For Free To First-Time Investors

- Col Financial Platform Can Be Accessed On Any Gadget

- Online Application Is Accepted

- Easy To Fund Account

- 7 Day Free Trial Of Trading Account

- Buy/Sell Reminder

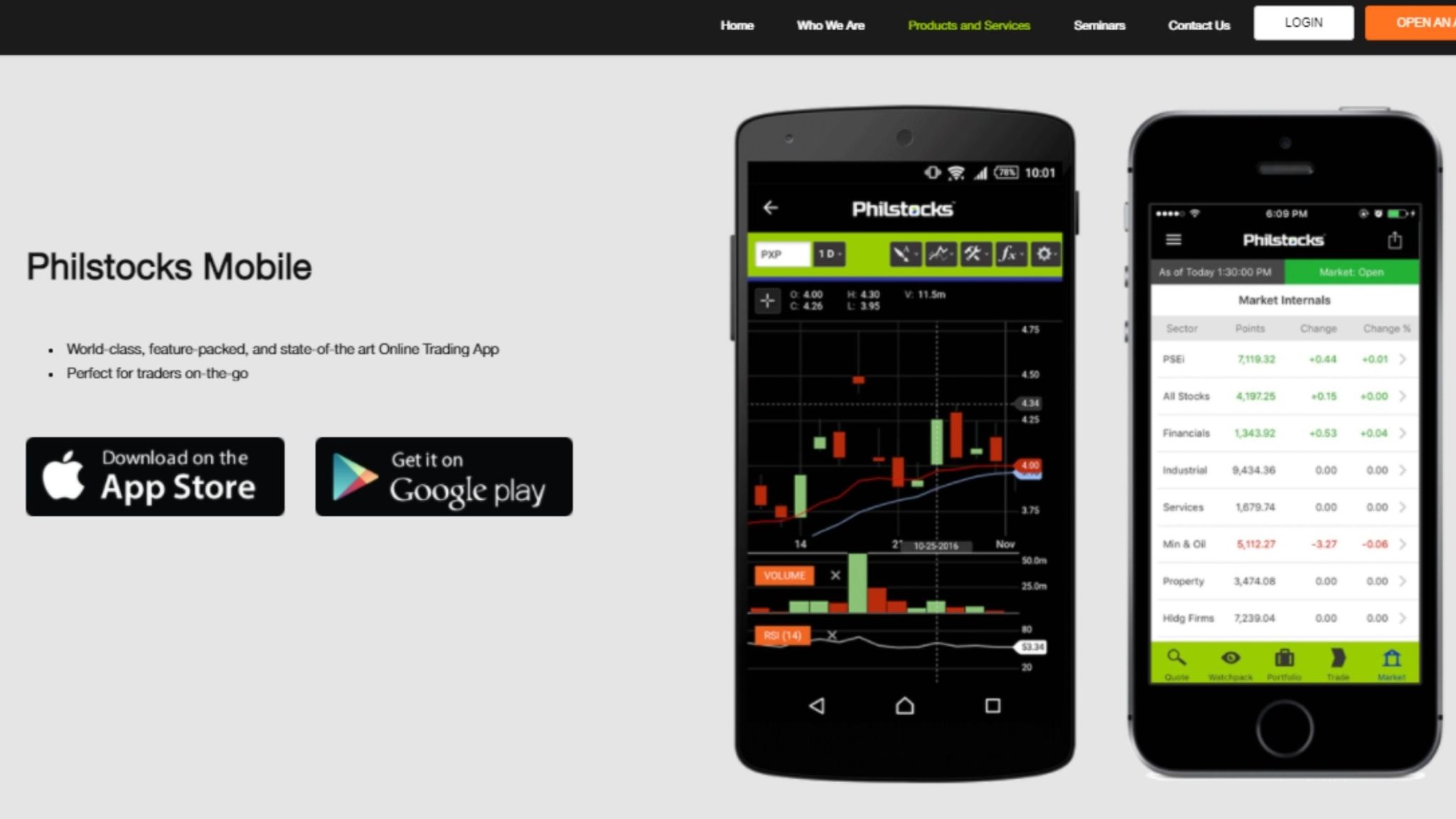

2. Philstocks

Philstocks Financial, Inc. (formerly Accord Capital Equities Corporation). Philstocks is another user-friendly interface for trading and investing stocks in the Philippines. Philstocks trading platform surely deserves to be one on the top. It continuously innovates its products to make the Philippines stock market more accessible for the investing public. Philstocks has a minimum account opening for only P1,000.

How To Open A Philstock Account?

You can visit Philstocks.ph, and from there, you have the option to fill out and apply for an individual account. Altantivly, You can mail the documents via an agent or take a trip to your local branch.

Head Office: G/F, East Tower, Phil. Stock Exchange Centre, Pasig City Binondo Branch: Unit C 2nd Floor, ETY Building, 484 Quintin Paredes Street, Binondo, Manila. Email [email protected] Business Address: G/F Unit EC-05B East Tower Philippine Stock Exchange Center ER Exchange Road, Ortigas Center, Pasig City Philippines 1605

The details above also serve as the primary contact details of Philstock; however, you can also reach them via social media.

What Documents Are Required To Open A Philstock Account?

- Two Primary IDs: Passport, SSS, GSIS, UMID, TIN ID, Driver’s License

- For foreigners who are permanently residing in the Philippines: – Foreign Passport or Foreign Driver’s License and your Alien Certificate of Registration (ACR)

This may differ if you are investing from overseas or are a foreign investor. Therefore, we recommend contacting the Philippines stock broker directly if you have any questions about their service/requirement.

Ecomparemo.com is an excellent source of information, which added some extra details on this topic. They state, “If you only have one Primary-ID, you may submit secondary IDs instead. Acceptable secondary IDs are Postal ID, Senior citizen card, NBI Clearance, Credit card, ATM card, Company ID (current employer), and, for Students: Student ID (current school year), PSA Birth Certificate.”

Benefits Of Using Philstock As A Stock Broker in the Philippines.

- Android/iOS App available

- Free online education for first-time investors

- 7 days of trial online trading account

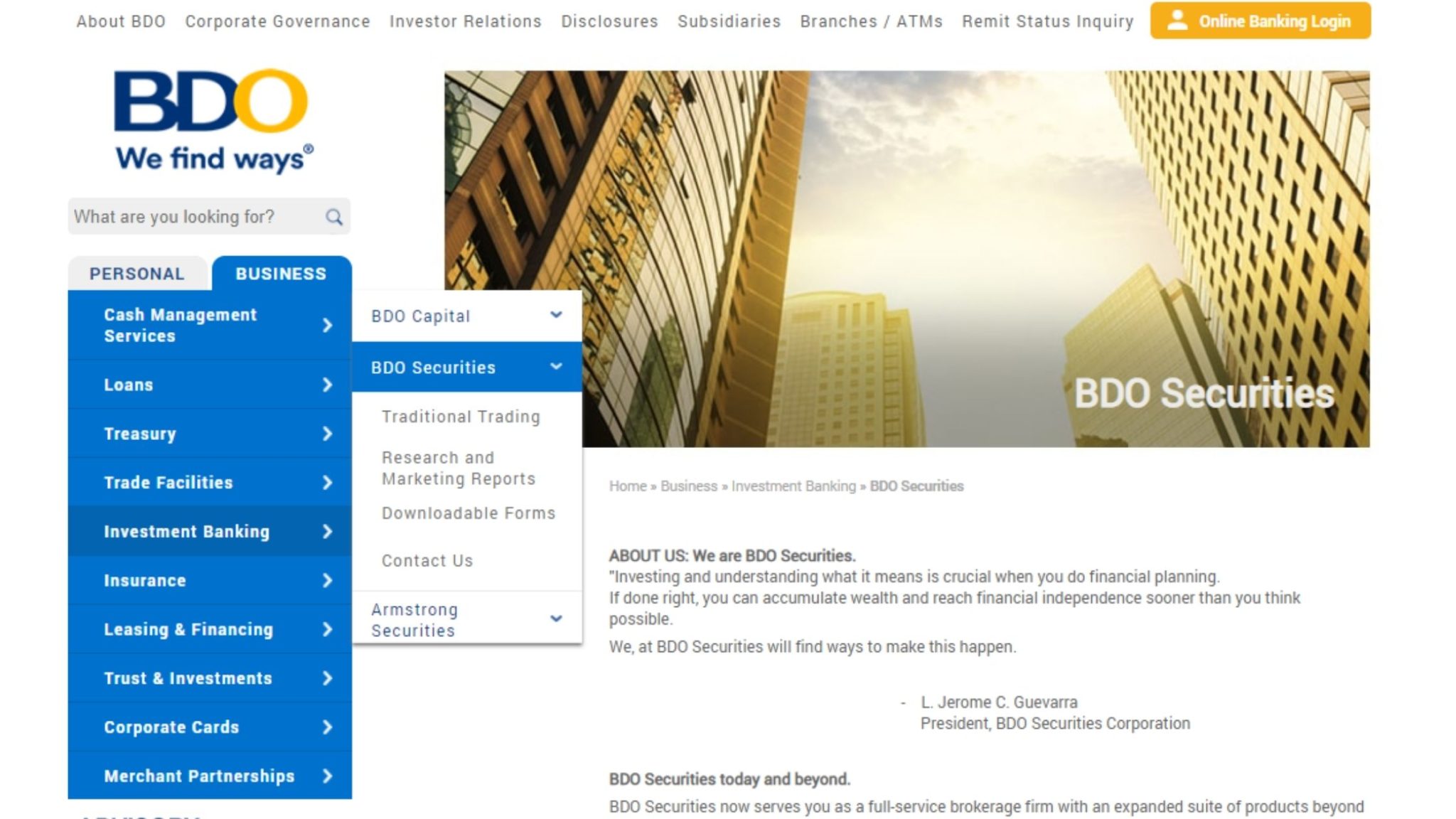

3. BDO Securities

BDO Securities is on the third spot of best stock market brokers in the Philippines. BDO is known for its great and fundamental analysis. If you’re a BDO account holder, you won’t need initial funds to open an account.

BDO states, “We serve you as a full-service brokerage firm with an expanded suite of products beyond equities, to include but not limited to fixed income securities and investment funds, both local and global.”

They are firmly poised to become one of the country’s leading brokerage and wealth management partners for retail investors.

How To Open A BDO Securities Account?

You can create an account and Sign Up online via bdo.com.ph/securities/opening-account. However, if you prefer, you can also pop into one of the many offices they have across the nation.

Online Trading Contact Information – Website www.bdo.com.ph/securities Telephone: +63 2 8702-7878 Domestic Toll-Free 1 800 10 702 7878 Email: [email protected]

The details above also serve as the primary contact details of BDO securities; however, you can also reach them via social media.

What Documents Are Required To Open A BDO Securities Account?

List of valid ID’s

- Passport (In Case Of Foreign Passport, Must-Have English Characters/Translations, And The Holder Must Have A Residential Address In The Philippines)

- Philippine Postal ID

- Tax Identification Number ID

- New Social Security System (SSS) ID

- Government Service And Insurance System (GSIS) E-Card

- Philhealth Card

- Driver’s License Issued By The Land Transportation Office (LTO)

- Senior Citizen ID

- Voter’s ID

- Integrated Bar Of The Philippines (IBP) ID

- School ID (For Minors)

- Professional Regulations Commission

This may differ if you are investing from overseas or are a foreign investor. Therefore, we recommend contacting the Philippines stock broker directly if you have any questions about their service/requirement.

Benefits Of Using BDO Securities As A Stock Broker in the Philippines.

- Easy Access For BDO Customers

- No Monthly Charges

- Easy & Paperless Online Application

- Psetradex Platform

- Best For Expert Or Intermediate Investors

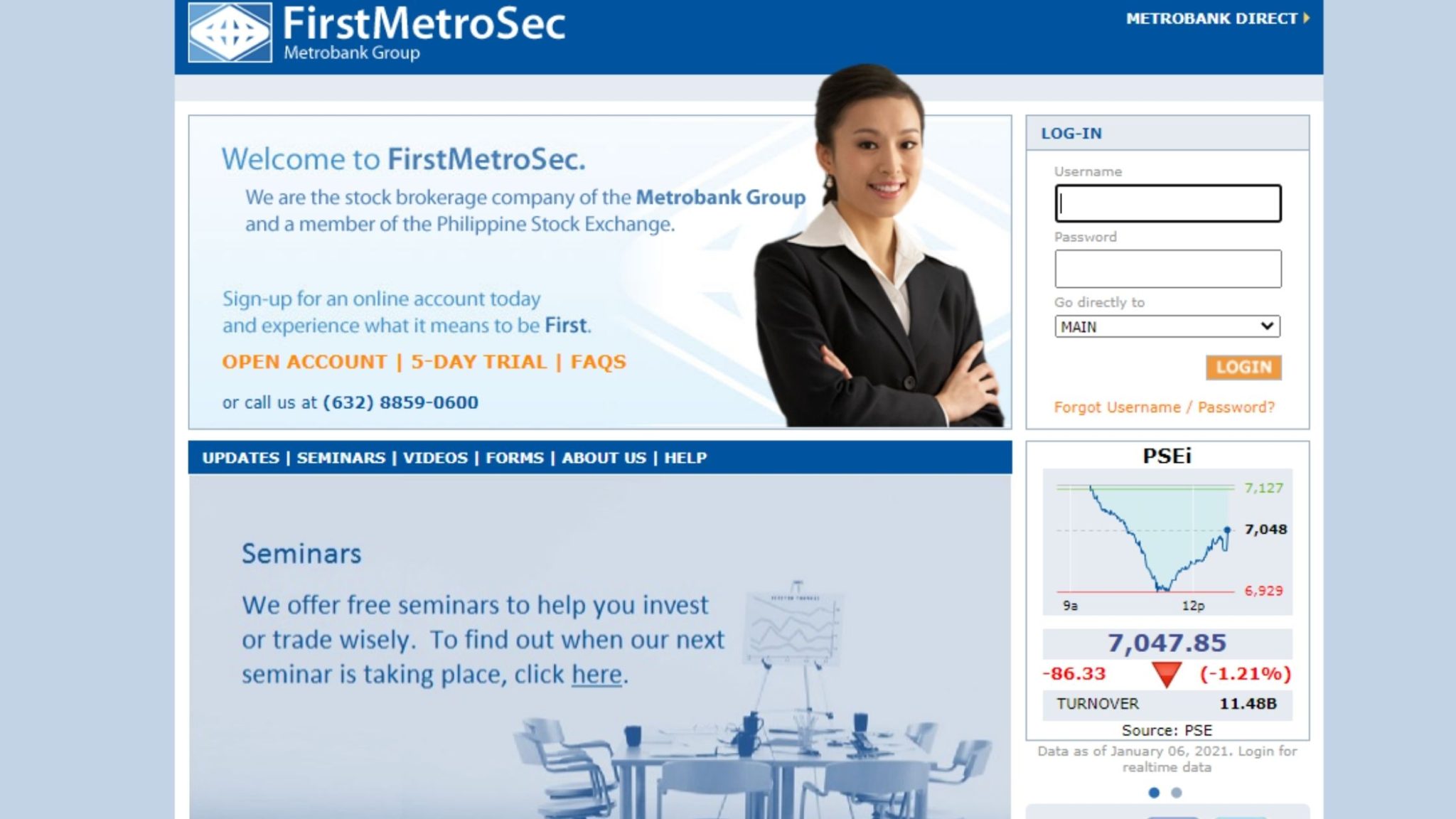

4. First Metro Securities

The second stock market broker in the Philippines (by Metrobank group) The upgraded version of First Metro Sec is First Metro Sec Pro. It is the most advanced online stock trading platform in the country, generating great reviews right now. Everything you need is served on the screen as quickly as possible.

You can monitor, analyze, and trade stocks and mutual funds conveniently. In addition, you can customize your dashboard look by choosing from available theme colors, sidebar, ticker, and portfolio options. Every feature is easy. F.M.S also offers Mutual Funds on its platform. Plus, there is no initial fund needed to open an account if you are a Metrobank client.

How To Open A First Metro Securities Account?

The best and quick option is through their website, firstmetrosec.com.ph. From there, you can complete an online application, or you can contact F.M.S in their location near you:

The on-site account opening requires a personal appearance in any of our offices from 9 am to 5:30 pm: Makati: 18F PSBank Center, Paseo de Roxas cor. Sedeño St., Makati City (02) 859 0600 – Cebu: GF Metrobank Plaza, Osmeña Blvd., Cebu City (032) 520 5695 Davao: GF Hotel Uno, CM Recto St., Davao City (082) 293 9354

The details above also serve as the primary contact details of first metro securities; however, you can also reach them via social media.

What Documents Are Required To Open A First Metro Securities Account?

List of acceptable IDs:

- Passport

- Driver’s License

- SSS Or GSIS Card

- PRC ID (Front & Back)

- Unified Multi-Purpose ID

- Philhealth Card

- TIN Card

- Voter’s ID

- Senior Citizen ID

- ID With Address

List of valid proof of billing statements:

- Bank Statement

- Credit Card Statement

- Insurance Statement

- Electricity Bill (I.E., Meralco)

- Water Bill

- Telephone Or Cellphone Bill

- Cable/Internet Bill

- Association Dues

- Remittance Receipt

This may differ if you are investing from overseas or are a foreign investor. We recommend contacting the Philippines stock broker directly if you have any questions about their service/requirement.

Benefits Of Using First Metro Securities As A Stock Broker in the Philippines.

- Android/iOS App available

- The seminar is given to first-time investors

- Market research

- It can be accessed on any gadget

- Metrobank customers can easily apply

- 5 days free trial of trading account

- Multiple Watchlists

- Amazing Interface

- Real-Time Market news

- Amazing and excellent research

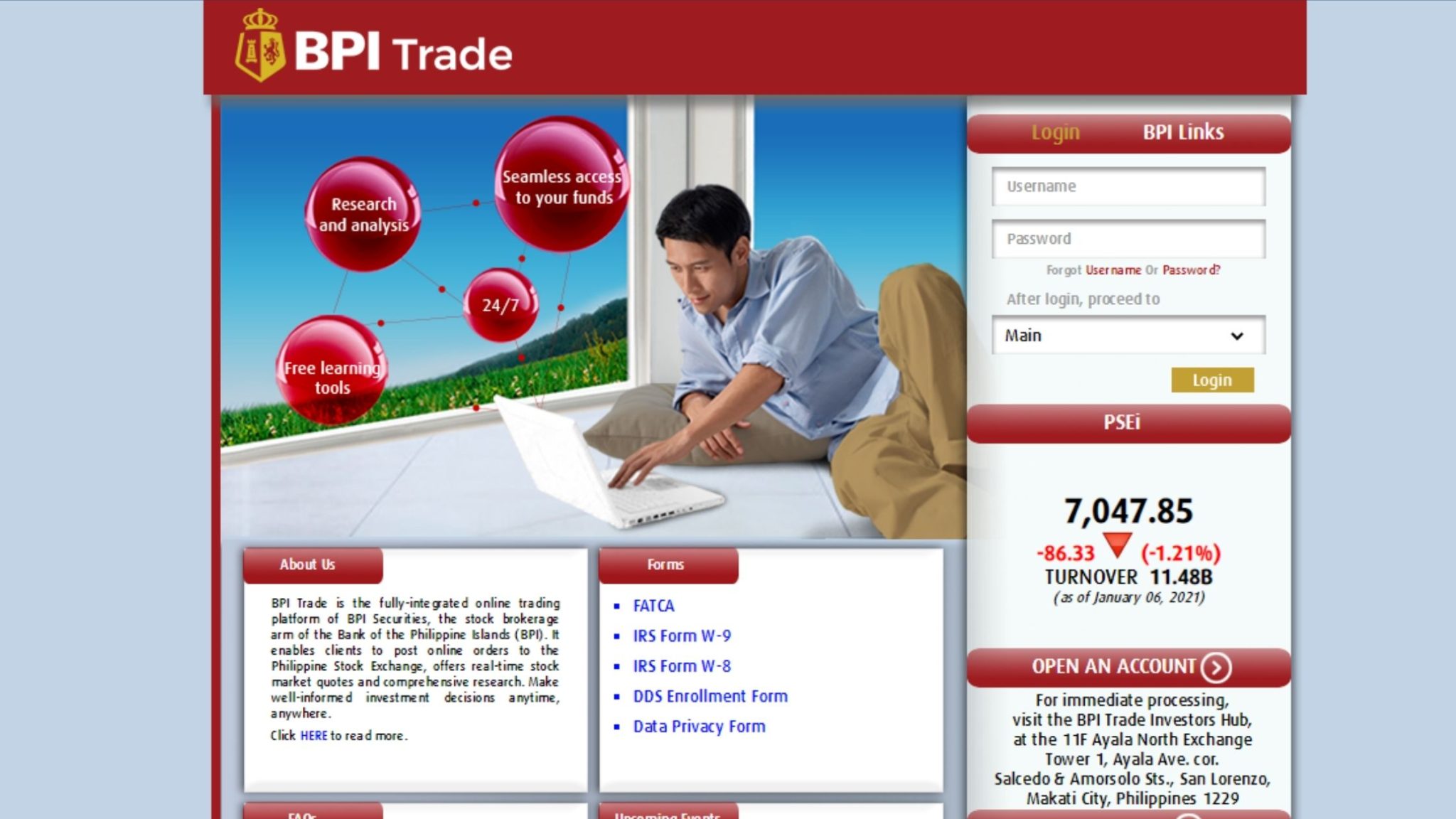

5. BPI Trade

BPI is an online trading platform affiliated with BPI Securities Corporation (one of the Philippines’ oldest stock brokerage firms). One benefit of BPI trade is is that you don’t have to deposit money when you open an account if you already have a BPI bank account. Additionally, Transact for only 0.25% of the traded amount for online trades. That’s currently the lowest commission rate allowed by the Philippine Stock Exchange.

How To Open A BPI Trade Account?

The easiest way to start a BPI trade account is online. bpitrade.com/ From this step, click open an account; after reading the Terms and Conditions, click the I AGREE link to proceed. Next, it is time to fill out the BPI Trade Online application form (You can also visit your nearest BPI or BPI Family Savings Bank branch with the application form.)

Address: 11F, BPI Securities, Ayala North Exchange 6796 Ayala Avenue corner Salcedo St. Legaspi Village, Makati City Philippines 1229 Toll-free number: 1-800-188-89100 Email: [email protected]

The details above also serve as the primary contact details of BPI Trade; however, you can also reach them via social media.

What Documents Are Required To Open A BPI Trade Account?

- Duly accomplished BPI Trade Online Application Form

- Signature Card

- FATCA Questionnaire

- Photocopy of 1 government-issued ID

- SSS/ GSIS number

- BPI Savings/Checking Account Number

This may differ if you are investing from overseas or are a foreign investor. We recommend contacting the Philippines stockbroker directly if you have any questions about their service/requirement.

Benefits Of Using BPI Trade As A Stock Broker in the Philippines.

- Online application

- 7 days trial trading account

- Easy account opening for BPI customers

- Great for traders

Extra Information & Resources: Stock Market Brokers In the Philippines

Stock Market

Refers to the marketplace where investors can buy and sell stocks. It is one of the most important sources for companies to raise money. This allows a business to be publicly traded or raise additional capital for expansion by selling shares of ownership of the company in the public market. In Asia, the Philippines stock market is one of the oldest markets established in 1927 and one of the most legitimate investment options in the country. The Philippine Stock Exchange (PSE) is the corporation that governs our local stock market. However, according to a Philippines Stock Exchange(2017) report, only a few are taking advantage of it.

Broker

A broker in the Philippines is a professional trader who buys and sells shares from clients. One of the major pros of being a stockbroker is the potential for fair pay. You can earn a very high salary if you stick with the job and are successful over time. Your pay can be enhanced by commissions and bonuses as well.

SEC = Philippine Securities and Exchange Commission.

More Philippines Investment Guides

- 11 BEST Investment With Monthly Returns Philippines

- 11 Investments That Pay Monthly Philippines

- 5 Best Investments for 10K In The Philippines

- 5 CRAZY New Investment In The Philippines

- 5 Good Investments Philippines For Students

- 6 BEST Retirement Insurance In The Philippines

- 6 Crazy High Risk Investments Philippines

- 7 BEST Investment With Compound Interest Philippines

- 7 Best OFW Investment Tips For PROFIT

- 7 BEST Short Term Investment In The Philippines

- 7 Key Investment Money Tips For Beginners Philippines

- 7 Super Good Investment In Philippines For OFW

- 9 Best Business Investments In The Philippines

- 9 Best Investment Tips Beginners Philippines

- 9 Small Capital Investments In The Philippines

- BEGINNERS Guide To Philippine Stock Exchange

- Best 7 Where To Invest 100K Pesos Philippines

- Best Stock Market Brokers For The Philippines

- How Investment Works In The Philippines For Dummies

- How To Be An Angel Investor Philippines

- How To Buy PLDT Stocks Philippines In 3 Steps

- How To Buy Stocks In SM Philippines In 3 Steps

- How To Buy Stocks Philippines 2022

- How To Invest In A Farm In The Philippines

- How To Invest In A Small Business Philippines

- How To Invest In Ayala Land Stock & REIT

- How To Invest In Blue Chip Stocks Philippines 2022

- How To Invest In Cebu Pacific Philippines

- How To Invest In Commodities Philippines

- How To Invest In Jollibee Stocks Philippines

- How To Invest In Lazada Philippines 2022

- How To Invest In Mutual Funds Philippines 2022

- How To Invest In Petron In The Philippines

- How To Invest In The Philippines From Abroad

- How To Invest In Wheat In The Philippines For PROFIT

- How To Invest Your Money Wisely Philippines

- How To Use Etoro Philippines

- Investing In Gold & Jewelry Philippines PROFIT

- Is It A Good Idea To Invest Money In Philippines Stocks?

- Low Risk Stocks For Beginners Philippines

- Philippines Stock Market For BEGINNERS

- Real Estate Investment Plan Philippines

- Top 10 Investment Companies Philippines

- What Is A Good Investment Philippines 2022

- What To Invest In Your 20s Philippines

- Where Can I Invest My 10k In The Philippines!?

- Where To Invest 1 Million Pesos Philippines

- Where To Invest 1000 Pesos Philippines

- Where To Invest 20K Pesos Philippines

- Where To Invest 5000 Pesos In The Philippines

- Where To Invest 50K Philippines

- Which Is The Least Risky Investment Philippines